In the national holiday pecking order, you’d probably least expect one reserved for a savvy and important tax-advantaged retirement account.

Yet, here we are. And, to think that we may never have been talking about this holiday or this tool if it weren’t for an accident.

It turns out that the 401(k) almost never came to fruition. In 1978 when Congress passed the Revenue Act, it included a provision that allowed employees to avoid being taxed on deferred compensation. Two years later, benefits consultant Ted Benna was doing research to help a client find a more tax-friendly way to save for retirement and referenced Section 401(k) of the Revenue Act to allow employees to save pre-tax money in a retirement plan.

While Benna’s client rejected the idea, he liked it enough to implement it in his own company. And thus, the first 401(k) plan was implemented.

Today, 401(k) are an essential component of smart retirement planning— and most of us hope to retire one day. That said, unless you’re a finance professional, they can be challenging to understand.

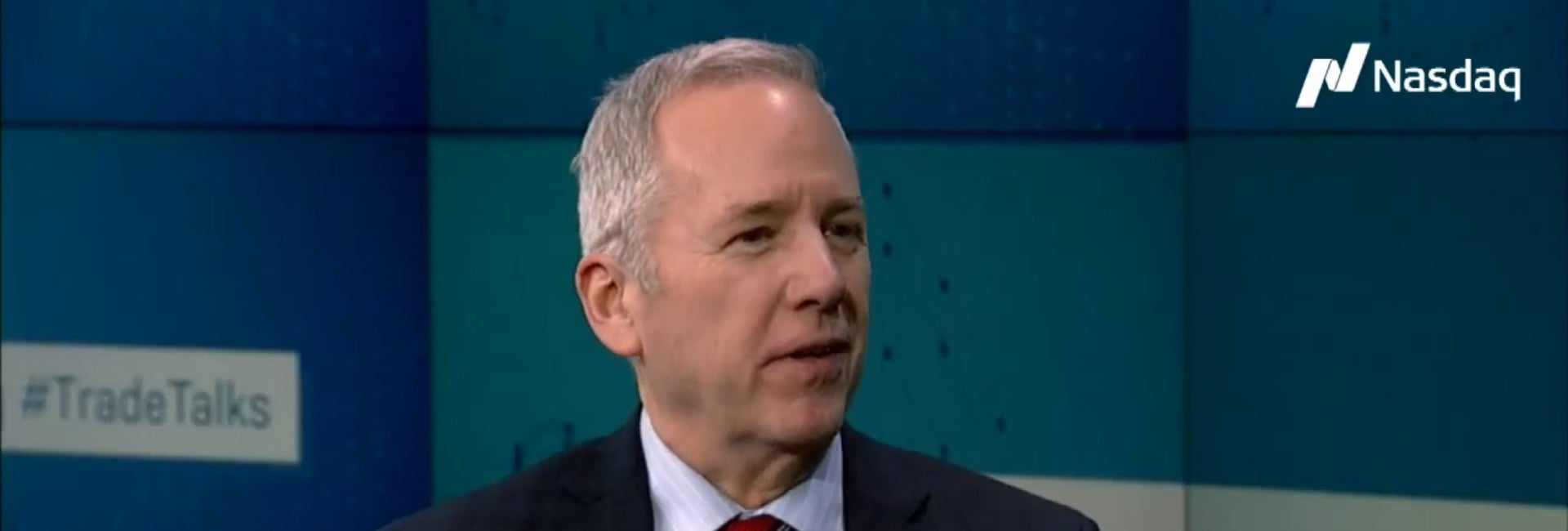

As part of our ongoing effort to provide educational resources to help you make better-informed decisions about your post-career life, we’ve talked to our resident expert, VP of Retirement Strategies Steve Resch, on the subject of 401(k) and retirement planning.

❓What are some mistakes that people make with 401(k) , and how can they avoid them?

My number one advice to anyone investing in a 401(k), leave it alone. Just put it in there and leave it alone and forget you ever have it. I feel very strongly that 401(k)s should be ignored. It should never be accessed until you go to retire.

💡Tip One: Don’t take money out of your 401(k) before you’re retired.

Once you start tapping into it, it opens a door. I’ve seen this happen so many times. I’ve had clients in the past that need money, and they’ll want to take it out of 401(k) —I encourage them not to— and sure enough, they take it out, they don’t pay it back. Before you know it, they go to retire and they have half of what they should have in that 401(k) because they tapped into it when they shouldn’t have.

People are far too conservative in their 401(k)s in their accumulation years. If you’re looking at a 30-year working career, that’s a long- term perspective. You should be taking in my mind more aggressive positions, don’t be so over diversified into bonds and safe investments because you have the advantage of dollar-cost averaging your investments in every single month, and you’ve got a long-term timeframe, so you want to be buying into the markets when they’re going up and down. Because over the long-term that’s where your real benefit’s going to come from. I don’t know if that makes sense or if I should clarify that any further?

💡Tip Two: Save way more for retirement.

❓Help settle this debate: Would you go for a pre-tax or a Roth, which would you advise?

That’s a tough one. I’ll be honest, I’ve always done pre-tax. I’ve always had the philosophy that you take advantage of whatever the best tax opportunity is for you at the current time, and let tomorrow figure itself out. But the Roth is such a phenomenal product, and it’s really hard to downplay the advantages of the Roth.

I’m in the camp right now where I would suggest people consider splitting contributions—But even then, you do have to look at your total tax picture. You have to look at your obligations and see what makes the most sense tax-wise. But I don’t think there’s any real simple cut and dry answer.

💡Tip Three: Go with a Roth if it makes sense for your situation.

❓So, it’s situation dependent?

It truly is. If it keeps you in your same tax bracket and you can handle the extra cost, then it makes sense to do. You also have to consider where you’re going to be tax-wise when you go to retire. Again, it’s a really tough call, but it is client specific and you really have to take into consideration all sorts of factors.

❓Can you help us understand the best practices for designating beneficiaries of your 401k?

Best practices for beneficiaries is also situation dependent. If you’re married, you’re generally going to want to have your spouse be the primary beneficiary. But you may have situations where you have second marriages involved, and you may want your children to be beneficiaries.

Again, it’s just one of those situations where you have to look at the entire picture. Here are a few guiding questions:

- What would happen to your 401(k) if you pass away?

- Does your surviving spouse need these funds?

- Are you anticipating for that surviving spouse to get them?

- Do you want your children to get the money?

The surviving spouse can take over the funds with no tax consequences at all. But if secondary or contingent beneficiaries—let’s say your children— were to inherit the 401(k), they would have a ten year time period with which they must take those funds out of that 401(k).

The stretch provisions are no longer in existence, so they can’t roll over that 401(k) into a beneficiary IRA, and take money out for the rest of their life. It has to be over a 10 year term.

There’s tax implications as far as that goes as well, because your children may inherit your 401k money during their peak earning years. This is a situation I’ve run into many times where the clients are concerned, “My son’s a doctor or a lawyer. They don’t need to inherit an extra three or $400,000 when they’re making that much every year, it’s going to kill them in taxes.” Again, those are considerations that you have to think about.

💡Tip Four: Consider your children’s financial status before making them a beneficiary.

❓How does a 401k play into the decision-making process of whether or not you should get a reverse?

Well, I don’t know that it really plays into that decision-making process. I think it’s an essential tool that everyone should have in their retirement planning process, as I think a reverse mortgage is as well.

If you’re a mass affluent investor— anyone with invested assets of up to three million dollars or so— I think reverse mortgage makes all the sense in the world. It’s a planning tool like a 401k, an IRA and like a long-term care insurance policy. It’s just another tool to bring to that planning process, so that you have all sorts of options available to you throughout your retirement period. This is where I like to suggest the reverse mortgage coming into play because now you have alternative income sources if your investments are underperforming. And you have alternative sources to draw on if you have long-term care expenses.

For me and my planning practice, it’s all about preserving and protecting the portfolio. Suppose I have access to capital in a home that isn’t doing anything for me—it’s not providing me income or anything like that. I’m going to use that capital to manage any risk that’s going to interrupt or disrupt the retirement income, and that’s a distribution plan that I have in place for my clients.

💡Tip Five: 401(k)s and reverse mortgages are a part of a well-rounded retirement strategy.

❓Do you have any advice or thoughts about how people should approach retirement planning after 2020? What are some lessons that we’ve learned and how can we plan better for when things get disrupted suddenly?

There’s a few lessons to learn from this. First of all, we had a historic drop in the market in March. There was good and bad to that.

One of the good things was that the recovery and the drawdown happened so fast that investors were truly in a state of shock. Many people did not have time to react, which worked to their benefit because they were still in the market as it started to recover. People who panicked and sold out at the last minute have been taken to the cleaners.

I think one of the lessons that we have learned from this is that you need the ability to ride out whatever is going on in the marketplace. You have to believe that it’s going to come back at some point in time, but that doesn’t address liquidity concerns you have during this market event.

💡Tip Six: In a bear market, don’t panic and sell all of your assets.

Liquidity is extremely important to be able to plan for that. I know a lot of people go into retirement planning, and they’ve got to take four percent out of their investments every year, and there’s no flexibility for anything that could go wrong. When you’re looking at a 30 year retirement period, anything can go wrong.

I think what we’ve learned from this year is, first of all, let the markets do its thing, but be prepared so that you can afford to let the market do its thing. Being prepared is having access to liquidity. That’s been my message all along with reverse mortgages. They bring liquidity, flexibility, and options to the financial planning process. When we look at even what the federal government did, why did the economy recover so quickly? It’s because the federal government dumped three trillion dollars into the economy.

This article is intended for general informational and educational purposes only, and should not be construed as financial or tax advice. For more information about whether a reverse mortgage may be right for you, you should consult an independent financial advisor. For tax advice, please consult a tax professional.

I WANT TO KEEP UP TO DATE ON RETIREMENT TRENDS

Follow Us.