A Leader in Reverse Mortgage Education

The Retirement Strategies Division at Finance of America Reverse (FAR) is the official provider of reverse mortgage education to the Financial Planning Association (FPA). We give you all the tools needed to help clients strategically leverage housing wealth as part of a comprehensive retirement plan.

What's a Reverse Mortgage?

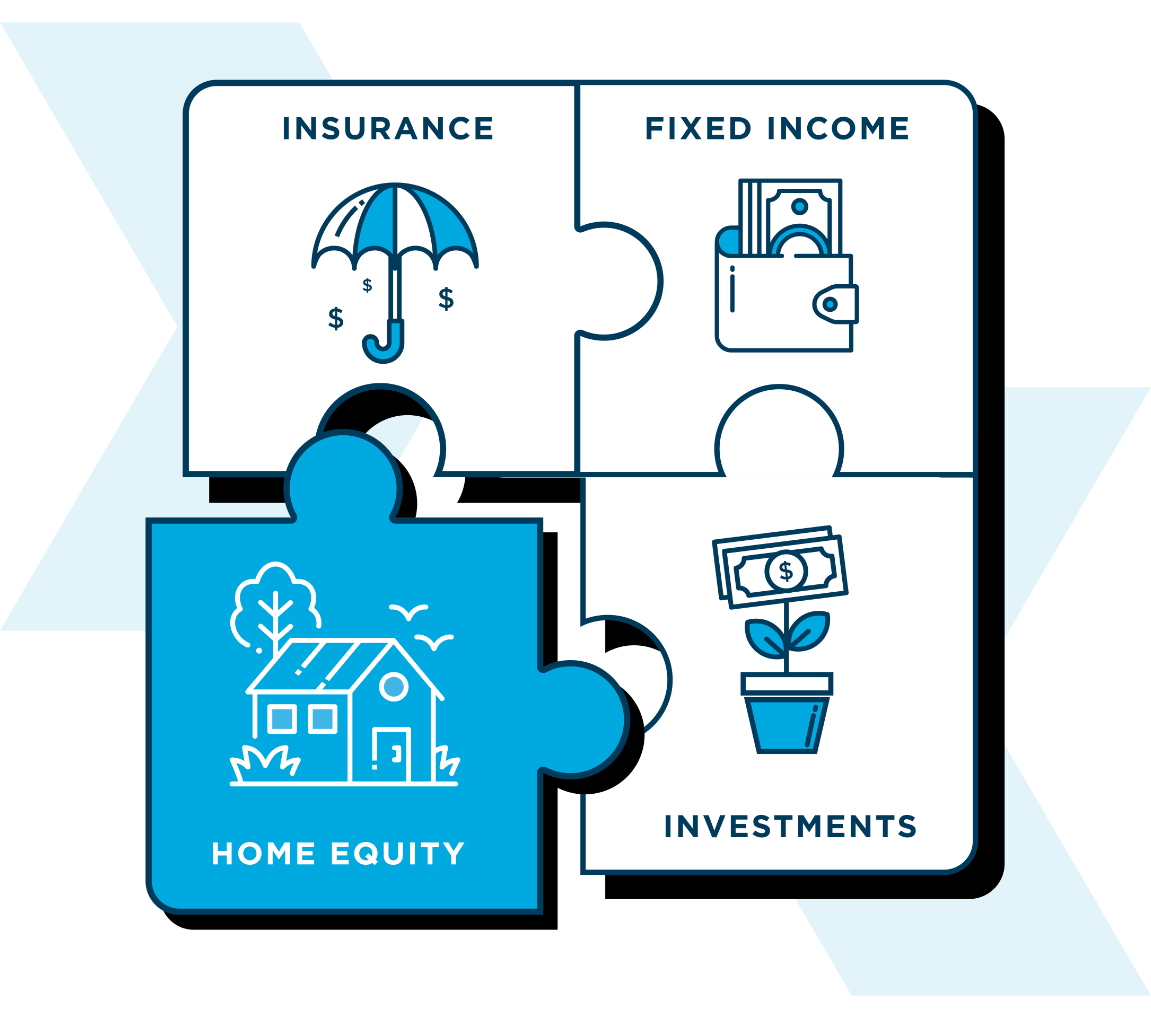

Your Clients Deserve All the Pieces

Discover all the ways home equity can be a strategic piece in solving the retirement puzzle.

Frequently Asked Questions

Yes. The borrower still retains ownership of the home and may sell it at any time with no prepayment penalties. The home is simply secured with a lien similar to a traditional mortgage or home equity line of credit.

There is never a required principal or interest payment during the life of a reverse mortgage loan. Homeowners are still required to pay property-related expenses, including taxes, insurance, and HOA fees.

Generally, the loan balance is due after the last borrower permanently moves from the home or passes away.

The borrower’s heirs may sell the home and keep any remaining equity if they wish, or refinance with a traditional mortgage if they want to retain the property. In the event the loan exceeds the value of the property, the heirs can choose to walk away via foreclosure with no responsibility to the remaining balance.

Yes, reverse mortgages are non-recourse loans, which means the lender can only look to the subject property for satisfaction of the mortgage lien. The borrower and/or heirs are never personally liable for satisfaction of the reverse mortgage.